How do lenders determine how much to lend

Ad Struggling to Find the Best Business Funding For You. Percentage Of Gross Monthly Income Many lenders follow the rule that your monthly.

/how-to-get-a-loan-315510_V1-e8212e1a3dfe43358308f689cf51a284.png)

How To Get A Loan From A Bank

Ad We Picked the 10 Best Personal Loan Companies of 2022 for You.

/how-to-get-a-loan-315510_V1-e8212e1a3dfe43358308f689cf51a284.png)

. Click Now Apply Online. The ratio is calculated by taking. Apply in Minutes Let Us Help.

You obtain the Upfront Mortgage. To calculate your maximum monthly debt based on this ratio multiply your gross income by 043 and divide by 12. To calculate how much you can expect to pay for your total loan get the Upfront Mortgage Insurance rate and add it to the base loan amount.

Lenders generally look for the ideal front-end ratio to be no more than 28 percent and the back-end ratio including all monthly debts to be no higher than 36 percent. To calculate your maximum monthly debt based on this ratio multiply your gross income by 043. Since cars are so expensive and used as collateral for auto loans lenders can usually charge interest rates on.

If a loan applicant has a credit history that indicates creditors losing their investment on them then the perceived risk goes up. Traditionally mortgage lenders applied a multiple of your income to decide how much you could borrow. Mortgage lenders expect a borrower to spend 28 or less of their monthly gross income on a mortgage payment.

Ad See How Competitive Our Rates Are. Apply Today Save Money. Apply For a Merchant Cash Advance Get Funded Within The Same Day.

A car loanauto loan typically has an interest rate between 4-5. Traditionally mortgage lenders applied a multiple of your income to decide how much you could borrow. The lender will do an independent appraisal of the property to determine its market value.

Lets then say your income is 47000 per year or 3917 per month. Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Lenders ask for a variety of information when you apply for a loan.

Mortgage lending discrimination is illegal. It helps them determine your ability to repay the funds within a specified time period. Student loans 250 credit card 100 car 300 mortgage 1000 1650 per month.

So if you earn 30000 per year and the lender will lend four times this. Here Are Some Of The Common Ways That Lenders Determine How Much You Can Borrow. That value is used to determine how much the lender will loan on a particular house.

Its Fast Simple. Your total monthly debt of. Your DTI is basically a comparison between what you earn.

Bad credit is OK. So if you earn 30000 per year and the lender will lend four times this. The Best Offers from BBB A Accredited Companies.

The first is a ratio of estimated monthly housing expenses principal interest property taxes and. Consequently lenders prefer a debt-to-income ratio that is. Similarly if the credit history evidences a consistent pattern of.

Mortgage lenders typically decide how much to lend based on the borrowers income as well as the debt-to-income ratio DTI. Mortgage lenders will typically use two ratios as part of the loan approval process. Generally most lenders want your debt-to-income ratio including your anticipated new monthly mortgage payment not to exceed 36 percent.

If you think youve. Most lenders recommend that your DTI not exceed 43 of your gross income. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

Fast Easy Approval.

Since 1934 The Federal Housing Administration Has Been Insuring Fha Home Loans In The U S With Competitive Fha Loans First Time Home Buyers Buying First Home

Family Loan Agreements Lending Money To Family Friends

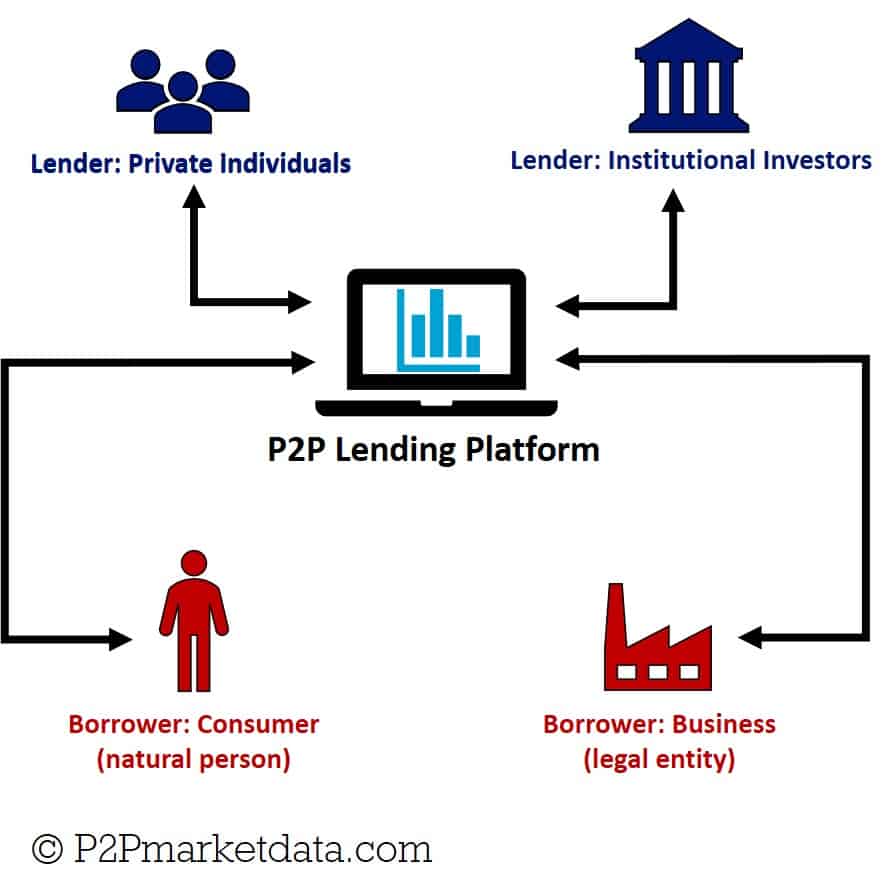

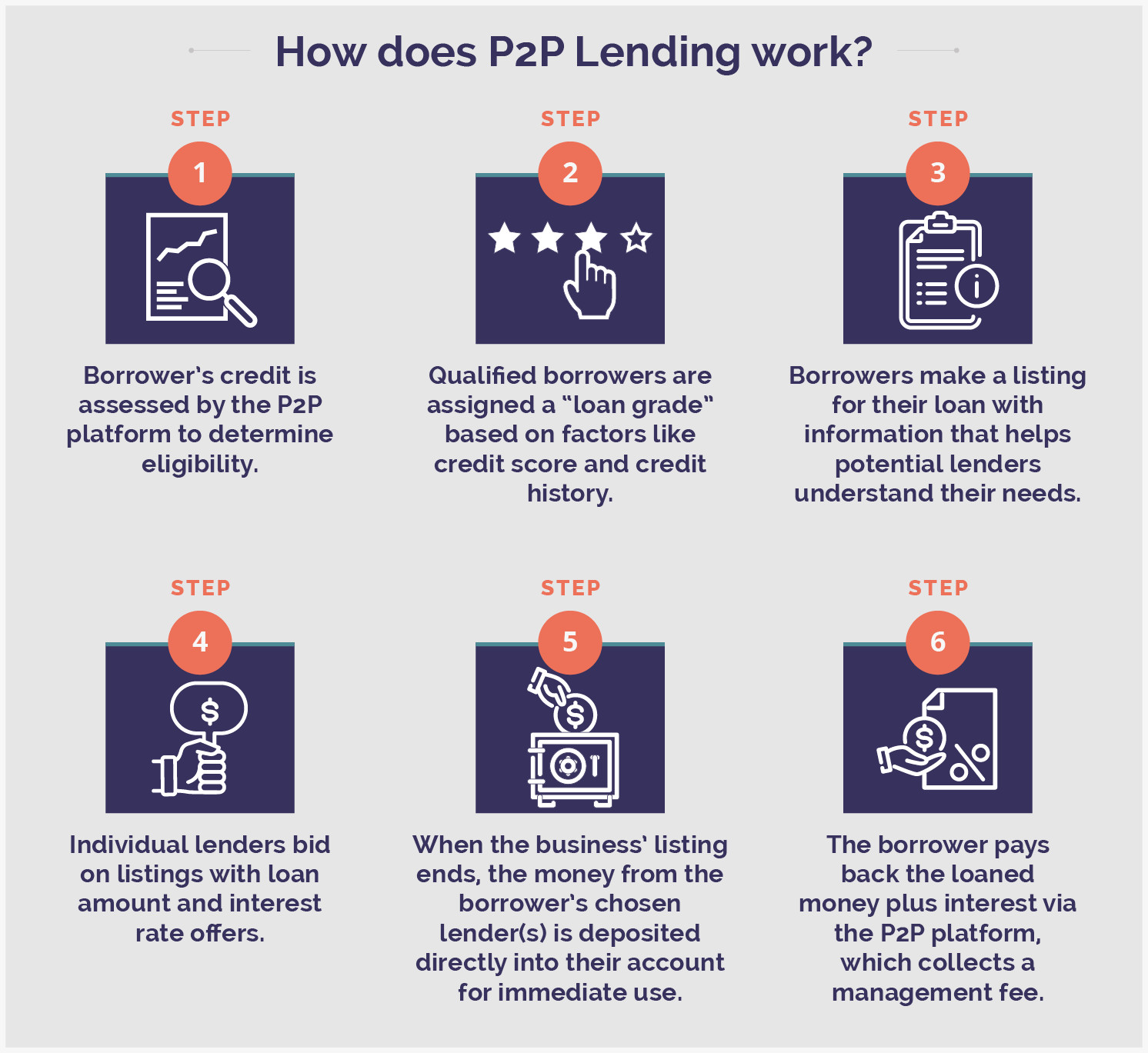

What Is Peer To Peer Lending How Does It Work Rbi S Latest Guidelines On P2p Lending Platforms Peer To Peer Lending Peer P2p Lending

/how-to-get-a-loan-315510_V1-e8212e1a3dfe43358308f689cf51a284.png)

How To Get A Loan From A Bank

What Is Balance Sheet Lending And How Is It Different To P2p Lending

Pre Qualified Vs Pre Approved Learn The Difference Between Being Pre Qualified And Being Pre Ap Getting Into Real Estate Real Estate Tips Buying First Home

Peer To Peer Lending An Alternative Source Of Finance Peer To Peer Lending Money Management Advice Economics Lessons

Top Options For Peer To Peer Business Lending Lantern By Sofi

Mortgage Ready Checklist Buying A Home Texaslending Com Home Buying Buying First Home Home Buying Process

How Much House Can I Afford Buying First Home Mortgage Marketing Home Buying Process

Mortgage Loan Approval Process Explained The 6 Steps To Closing The Hbi Blog Mortgage Loans Mortgage Loan Originator Mortgage Approval

Peer To Peer Lending Bonanza Targeted By Mortgage Bank Loandepot Mortgage Banking Peer To Peer Lending Peer

Understand The 5 C S Of Credit Before Applying For A Loan Forbes Advisor

What Does Heloc Mean In Real Estate A Home Equity Line Of Credit Or Heloc Is A Lo Real Estate Marketing Quotes Real Estate Agent Marketing Real Estate Terms

:strip_icc()/what-to-know-before-getting-a-personal-loan-e4d1a8b84f154c87b0615537de2aa520.jpg)

How Long Does It Take To Get A Loan

Fha Vs Conventional Infograhic Mortgage Loans Home Loans Fha Mortgage

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage Louisville Kentuc Mortgage Loan Originator Va Loan Home Loans